With Starknet staking now live and over 108 million STRK already staked, token holders are looking for optimal ways to participate. This guide covers how to stake STRK while accessing DeFi opportunities on Starknet, allowing you to earn both staking rewards and additional DeFi yields.

Traditional vs Liquid Staking

When staking STRK, you have two options:

- Traditional Staking: Lock your STRK directly with Starknet’s staking contract. Your tokens remain locked for the duration of the stake, earning staking rewards but unable to be used elsewhere.

- Liquid Staking: Stake and receive liquid staking tokens. These represent your staked position while remaining usable across DeFi protocols. Your original stake continues earning staking rewards at the same rate as traditional staking, while you can get additional yields by participating in DeFi.

Stake your STRK

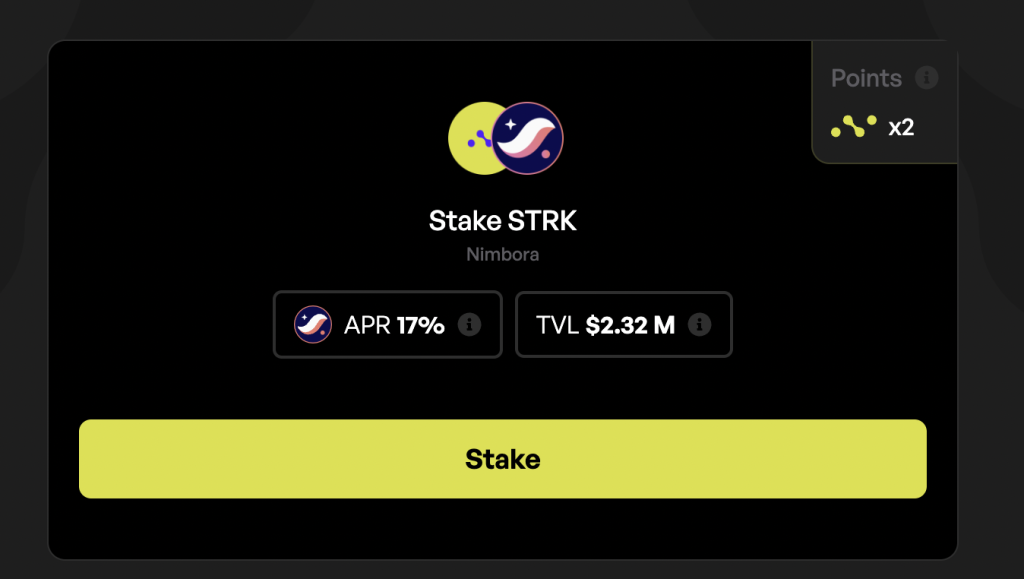

To start earning additional yield on your STRK, you’ll first need to stake it through Nimbora.

Nimbora has emerged as a key infrastructure provider on Starknet, currently securing over $14 million in total value locked (TVL).

The team behind Nimbora brings significant expertise to Starknet’s DeFi ecosystem. Consisting former Ethereum core developers who also built Lido on Polygon, they’ve partnered with Starkware to develop critical infrastructure including DeFi pooling solutions and liquid staking derivatives.

Their track record includes successful deployments of multiple yield strategies with partners including EtherFi, Pendle, Puffer Finance, Angle Protocol, and Spark.

📝 How to Get Started with sSTRK

Step 1: Staking Your STRK

- Visit Nimbora’s dApp

- Connect your Starknet wallet (Braavos or ArgentX)

- Look for the deposit box or use the percentage buttons (25%, 50%, 75%, 100%) to choose how much STRK to stake

- Click “Deposit” and approve the transaction in your wallet

- Once confirmed, you’ll see your sSTRK balance in your Nimbora portfolio

Maximize Your Yield: 6 Ways to Use Your sSTRK in DeFi

Now that you have sSTRK, you can unlock multiple yield streams by participating in Starknet’s DeFi ecosystem while continuing to earn staking rewards. Here’s how you can put your sSTRK to work:

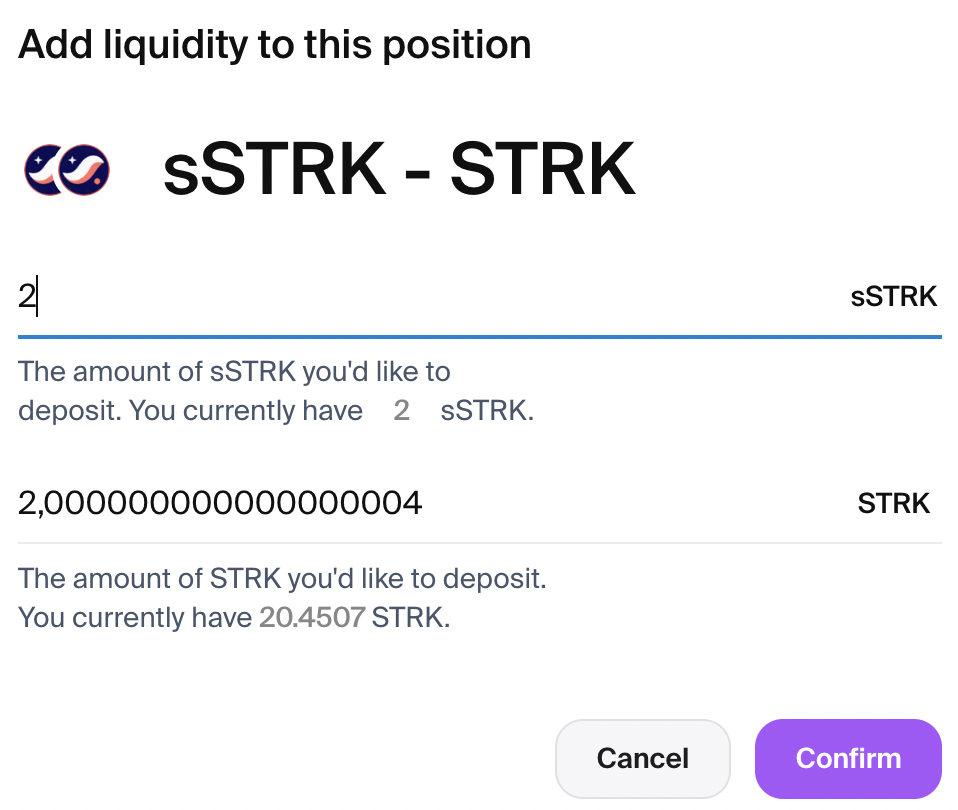

Add Liquidity on Ekubo 💧

Add your sSTRK to Ekubo’s sSTRK/STRK pool to earn:

- Trading fees from pool activity

- Additional DeFi Spring incentives

- Base staking rewards

- Position tracking via NFT

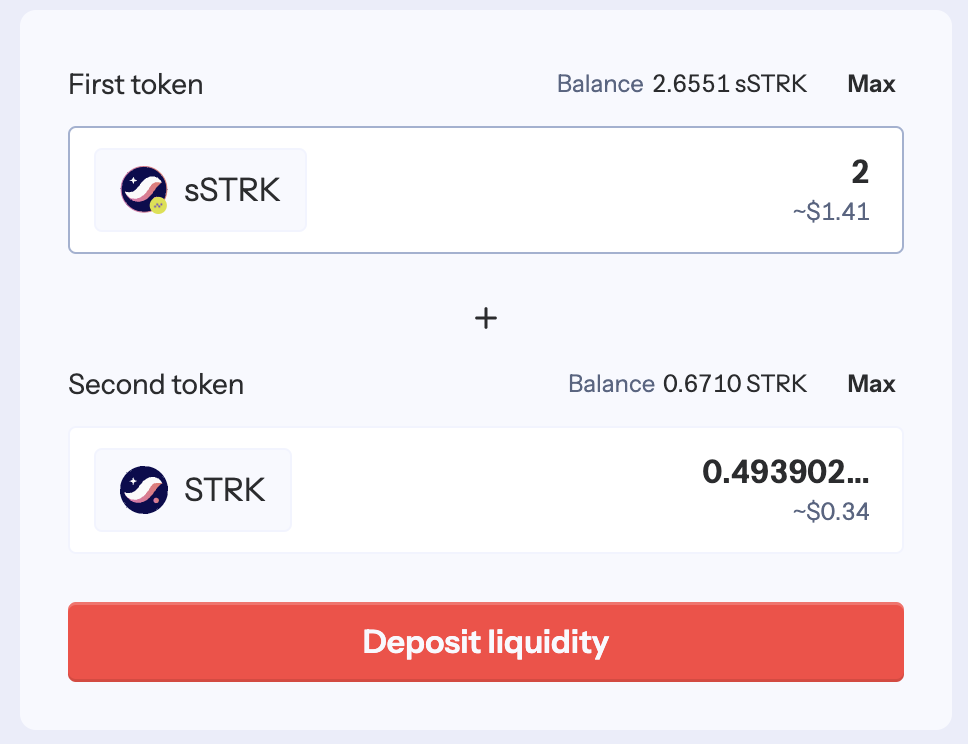

Provide Liquidity on Nostra 🌊

Provide liquidity in Nostra’s sSTRK/STRK pool to receive:

- Trading fee revenue

- DeFi Spring incentives

- NOSTRA-sSTRK/STRK position tokens

- Continuous staking rewards

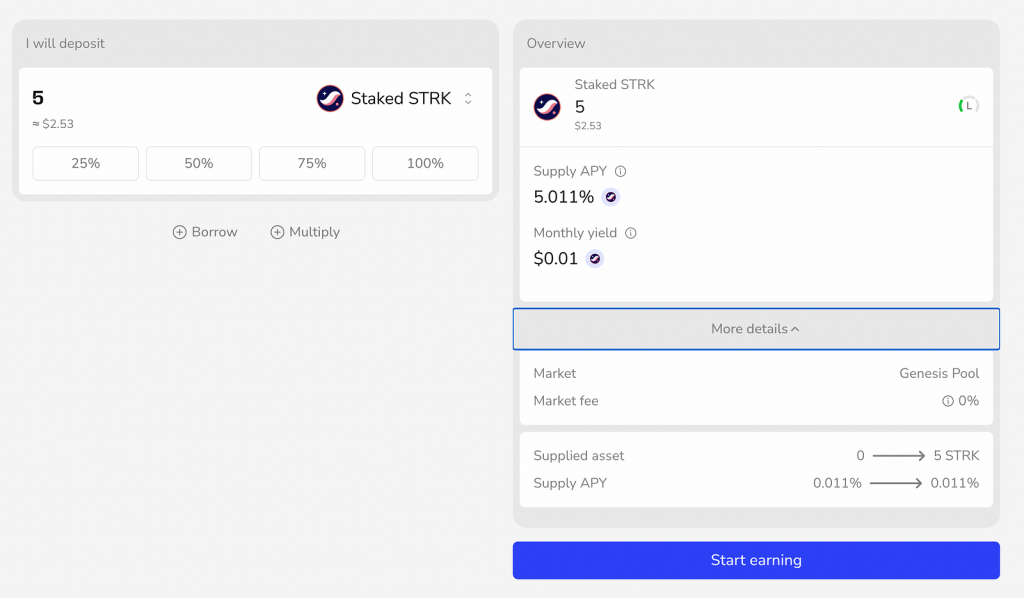

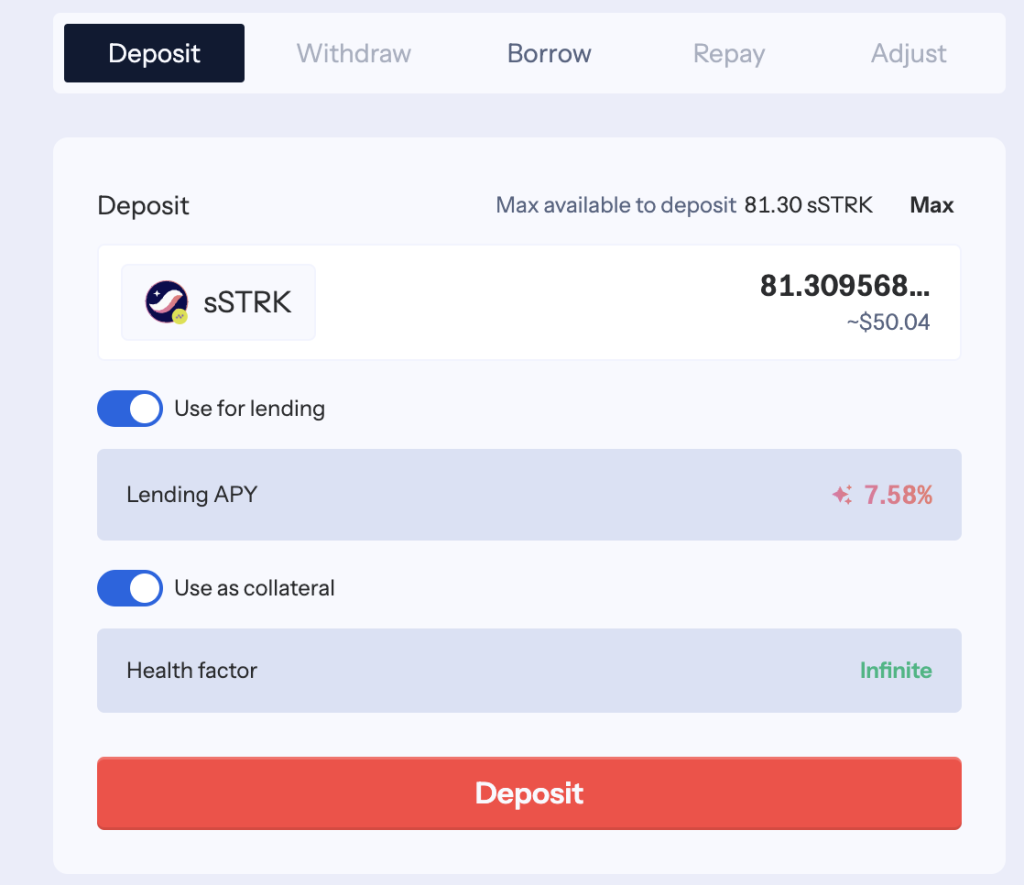

Lend on Vesu 💰

Deploy your sSTRK in Vesu’s lending market to:

- Generate lending APR

- Earn double Nimbora points

- Participate in Starknet’s lending ecosystem

Lend on Nostra 📈

Lend your sSTRK on Nostra’s platform for:

- Competitive lending yields

- Double Nimbora points

- Additional market exposure

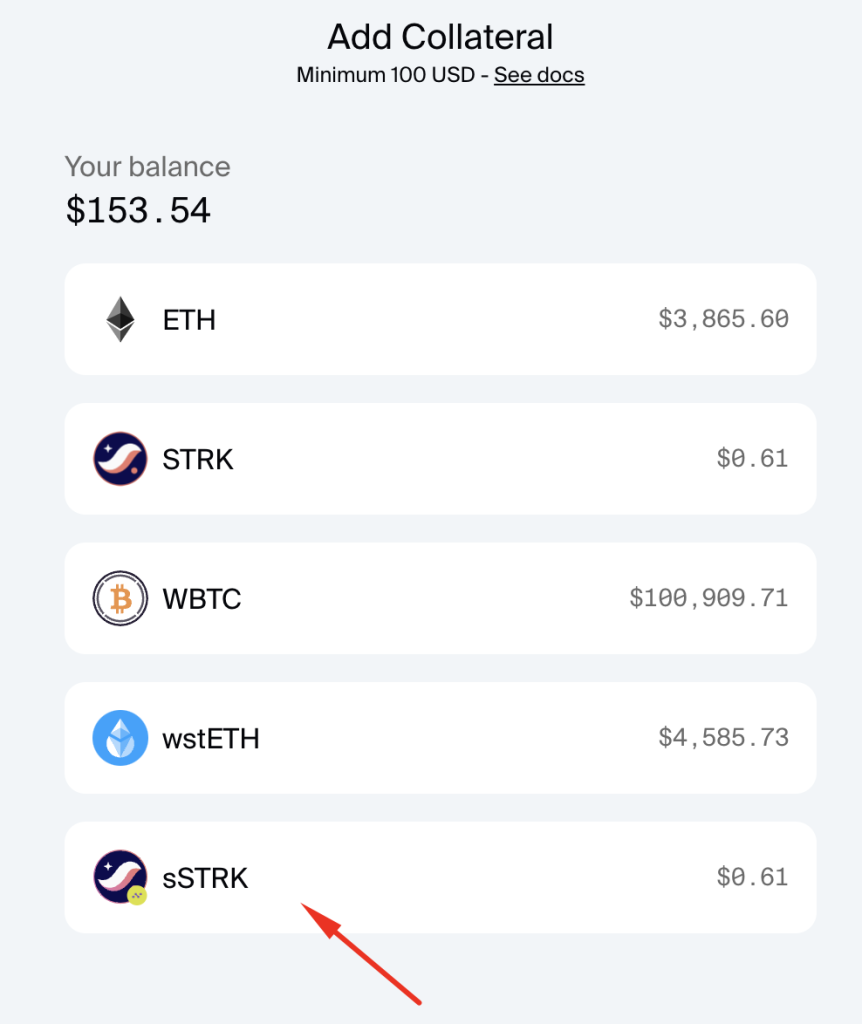

Borrow on Opus 🏦

Leverage your sSTRK on Opus to access CASH stablecoin with:

- Dynamic interest rate optimization

- Adjustable loan-to-value ratios

- Algorithmic stability mechanisms

Learn more in the Opus documentation

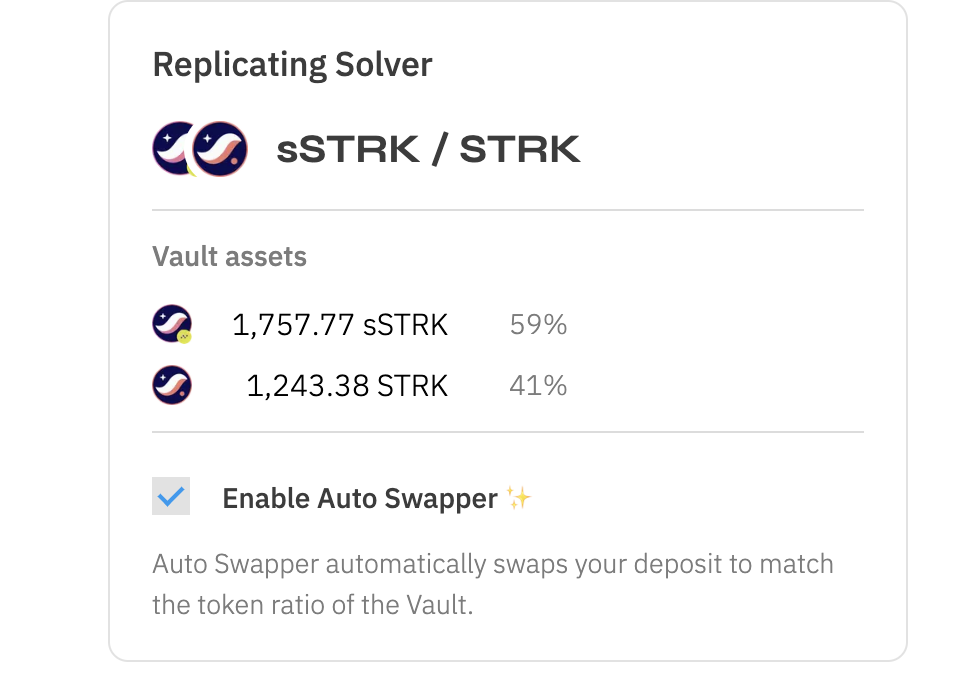

Yield Farm on Haiko 🤖

Deploy capital in Haiko’s replicating solver for:

- Automated portfolio optimization

- Gas-free position rebalancing

- Built-in impermanent loss protection

🛡️ Bank-Grade Security

Nimbora has been thoroughly audited by Zellic, a leading blockchain security firm trusted by major protocols in the industry. 👉 Get the audit here.

Their comprehensive audit ensures LST contracts meet the highest security standards.

🎯 The Bottom Line

sSTRK lets you earn additional yield while maintaining your stake in the Starknet ecosystem. You can provide liquidity, lend, or borrow across multiple platforms while continuing to receive staking rewards.

Have questions? ➡️ Join Nimbora Discord.

Disclaimer: This article is for informational purposes only. DYOR and understand the risks before diving into DeFi opportunities!